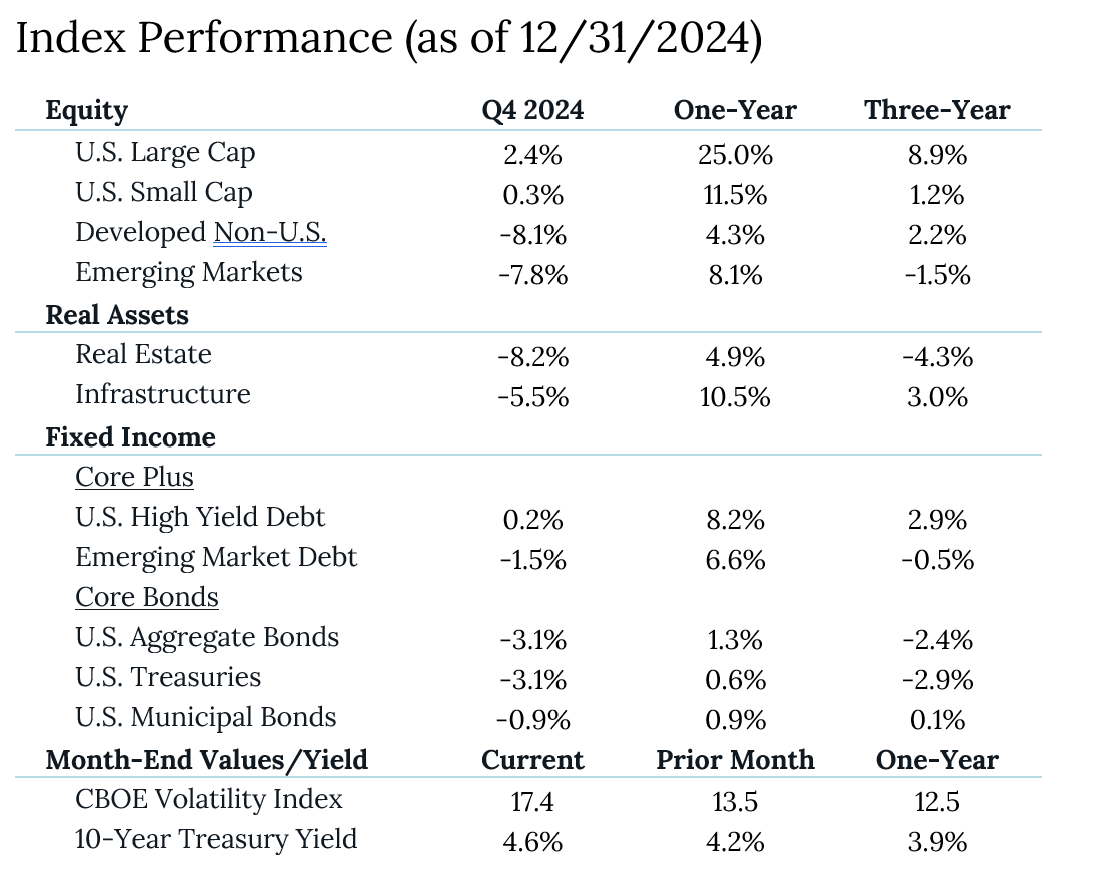

Despite market volatility in December, the fourth quarter of 2024 showcased the continued dominance of US equities, particularly in the Large Cap Growth segment, which posted an impressive 7.1% gain. This outperformance came amid significant market divergences, with developed international markets declining as the U.S. dollar strengthened and fixed income markets struggling as the 10-year Treasury yield climbed to 4.6% on worries about inflation and rising government debt. The U.S. economy demonstrated remarkable resilience, with strong holiday consumer spending and robust labor market data. However, persistent inflation prompted the Federal Reserve to maintain a more hawkish stance even while implementing its third consecutive rate cut to 4.25-4.5%. Given the combination of strong economic fundamentals and ongoing policy challenges, markets appear poised for continued complexity as we enter 2025.

Key Takeaways

- US Dominance: The S&P 500’s modest -2.4% monthly decline in December masks a significant divergence from global markets, as US equities continued to outperform international peers across market caps and styles. While developed international markets fell -2.3% for the month, their quarterly decline of -8.1% highlights the sustained strength of US market but also the strength of the US dollar.

- Growth Leadership: Large Cap Growth stocks demonstrated remarkable resilience with a 0.9% monthly return for December and 7.1% gain for Q4, dramatically outperforming Value’s -6.8% monthly and -2.0% quarterly declines. This performance gap underscores the ongoing market preference for strong growth prospects as rates stay high.

- Small Cap Struggle: Small cap stocks faced significant headwinds with a sharp -8.3% monthly decline, though managing a slight 0.3% quarterly gain, highlighting the challenging environment for smaller companies. Investors are conflicted and thought we would see a more significant rotation into small caps as rates were cut. Policy uncertainty caused the long-end of the yield curve to rise, cutting expectations for these firms.

- Fixed Income Pressure: The fixed income market reflected ongoing rate uncertainty, with long-term Treasury bonds declining -6.4% in December and -9.7% for the quarter, as the 10y Treasury yield moved from 3.9-4.6% during the quarter. Bond returns for the year were more muted than expected given the high starting point for yields and the 10y Treasury yield will start 2025 higher than at the start of 2024.