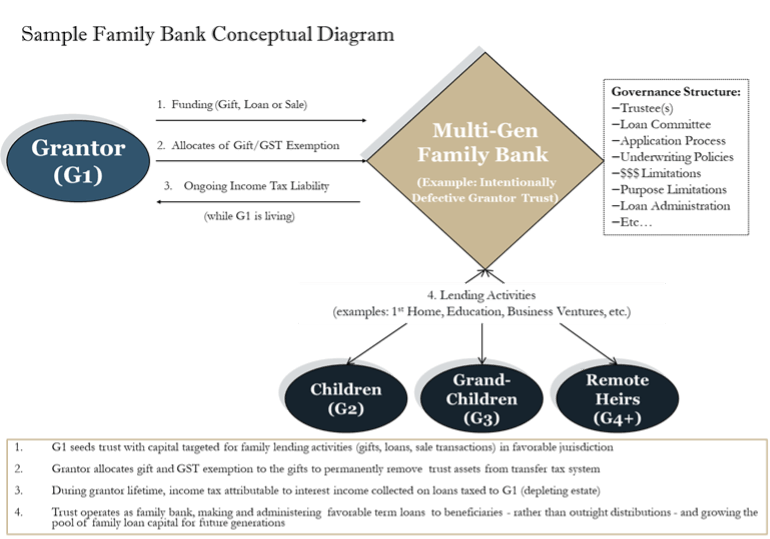

Family Bank

A Family Bank can be any pool of family capital that extends loans to or invests capital with family members on terms not available to them commercially. It may loan money to family members or even provide co-investment opportunities. Family banks are usually formed from new or existing pass-through entities (family partnerships or LLCs) or dynastic irrevocable trusts that are further customized to serve a defined set of family goals and objectives such as:

- Promoting engagement and participation in overall family wealth and investment planning

- Deploying financial resources to specifically offer human and intellectual capital growth opportunities

- Affording next-generation family members opportunities that the senior generation never had

- Incentivizing entrepreneurial interest, behavior, or activities

- Educating and serving as a forum for learning financial and business strategy, skills, responsibility, and accountability

- Identifying collaboration opportunities for family members on new businesses or investment opportunities

Family loans are generally made for either Investment opportunities with the potential to increase the family’s financial capital or Enhancement opportunities with the potential to increase the family’s human or intellectual capital.

Investment Opportunities

Investment-related activities require family borrowers to develop a business plan and submit a loan application, like those required by commercial lenders. The borrowers then participate in dialogue with the bank’s board and advisers over the feasibility of the project (think Shark Tank!). If granted, the borrower then provides the bank regular business reporting and updates and repays the loan as if working with a third-party lender.

Enhancement Opportunities

Enhancement related activities are more geared towards personal or professional development purposes and are underwritten based on indirect financial criteria like increased beneficiary independence or how the bank’s investment or loan might add to the family’s overall intellectual capital. While a formal loan application/contract and regular progress reporting are required, there may or may not be a repayment expectation.

Policy Considerations

Whatever the ultimate purpose, well defined and established policies and procedures will provide borrowers and lenders an equitable/comfortable environment to enhance financial training, encourage responsible borrowing, and promote a successful financial or professional outcome.

Such formalities might include:

- A mission statement or other expression of family values

- Well defined governance with an advisory board of family and non-family advisors

- Standard loan application, processing, and administration procedures

- Accommodative, yet well-defined loan provisions and expectations of repayment

Depending on the desired size and complexity, family banks can range from a simple segregated bank account with informal loan guidelines to a fully customized, multi-generational trust with the family banking governance structure, policies, and procedures as its singular focus. The structure will be determined by your intended purpose and duration. Note that structures intended to benefit multiple generations require special considerations including:

- Federal Generation Skipping Transfer Taxes

- Selection of jurisdiction with favorable statutes

- Fiduciary statutes

- State income tax

- Rule against perpetuities

Whether looking to leverage an existing entity or create a new one, working with your professional advisor team is highly recommended to ensure all tax, legal and fiduciary constraints and considerations are fully vetted and understood.

Family banks are growing in popularity as one of many tools successful families can use to foster a culture of entrepreneurship and financial responsibility among children and grandchildren, promote personal or professional development, and potentially create new wealth. Should you wish to explore whether a family bank or other arrangement might further your family wealth goals, please speak with your Pathstone client service team.