Quarterly Commentary

- As we enter Q1 of 2023, there is a growing concern that the U.S. economy might enter a recession. Our Market Cycle Dashboards have been negative for seven consecutive months now and is at its lowest reading since April 2020.

- Consumers have been largely resilient so far during this bear market. However, higher rates will continue to weigh on home-building and business investment. With personal savings rates near Global Financial Crisis lows, spending that was supported by stimulus could dry up in 2023 and has shown some signs of cooling already.

- A strong labor market and increasing nominal wages has kept the U.S. economy relatively stable in the face of widespread inflation. Nonfarm payrolls have surprised to the upside 9 of the last 12 readings, including the last 4 (Sep-Dec). Job cut announcements are starting to spike and spread to sectors other than tech. While announcements might not lead to actual layoffs, continuing claims for unemployment have risen to its highest level in the last 11 months and are 30% above May lows.

- Corporate profit margins are facing headwinds from input costs, dropping from 13% at their peak to 11% at year-end and may continue to be challenged as wage pressures persist.

- There are encouraging signs that a persistent downtrend in inflation is underway. Headline CPI is down to 7.1% YoY from the peak of 9.1% in June. Given the low month-over-month changes in inflation we have seen in the past five months, there is a clear path to a sub-3% year-over-year inflation rate in 2023.

- The Fed Funds rate was increased 125 basis points during Q4 to an upper bound of 4.5%. We believe the Fed is close to the end of this tightening cycle which, by their own estimates, could peak around 5-5.25%. Market prices indicate that investors believe the Fed will be forced to begin cutting rates in the second half of 2023.

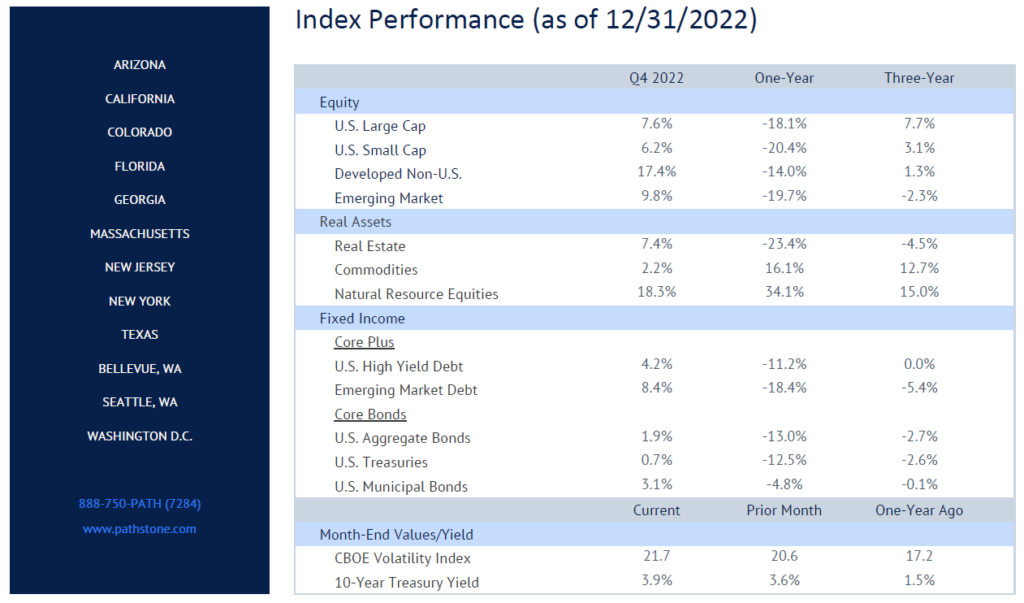

- 2022 was a challenging year for a balanced portfolio as equities and bonds both suffered double-digit losses. With interest rates higher than they have been in 15 years and a potential recession on the horizon, we anticipate that fixed income returns will be much better in the year ahead.

You cannot invest directly in an index; therefore, performance returns do not reflect any management fees. Returns of the indices include the reinvestment of all dividends and income, as reported by the commercial databases involved. Returns over one year have been annualized.

Source — Bloomberg, Morningstar, treasury.gov. S&P Dow Jones Indices.

Please see PDF for important disclosures.