Key Takeaways

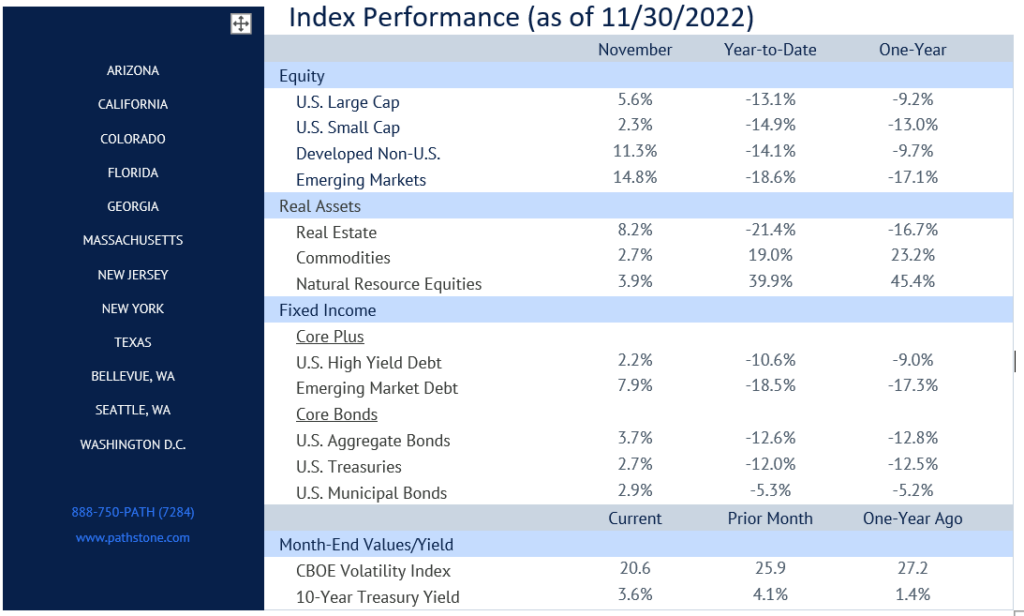

- November proved to be one of the best months of the year in terms of total market performance. The S&P 500 has now had two straight positive months for the first time since August 2021. Fixed income markets also rallied as longer maturity bond yields dropped. The yield on the 10-year treasury moved to 3.61% from 4.05% last month.

- Value outperformed growth again during November. Industrial and Materials sectors led U.S. equity performance. Consumer discretionary and energy sectors were laggards for the month but were still positive overall.

- While it was a good month for U.S. equities, it was an even better month for international. The U.S. dollar index dropped 5% and provided a boost for USD denominated foreign assets. European and Japanese equities were up 11.4% and 9.7% in November. Emerging markets were up almost 15% as Chinese equities rallied almost 30%.

- The rally in equity markets provided a boost for investment grade corporate bonds, which were up over 6% in November.

- The Fed funds rate was raised another 75 basis points to an upper bound of 4.0%. Right now, there is a high probability of a 50 basis point hike in December. CPI rose by less than expected in October to 7.7% YoY. Fed Chair Jerome Powell tempered expectations in a recent interview and claimed “that we have more ground to cover” despite cooling inflation and improving supply chain data. Even with hawkish comments from the Fed, markets rallied on the news of cooler inflation and potentially slower pace of rate hikes.

- Real GDP for Q3 was revised higher due to better than expected consumer spending and net exports. Retail sales beat forecasts with the biggest jump since January. At the same time, several measures of business growth including the S&P Global U.S. Composite and ISM Manufacturing surveys fell further into contractionary territory, signaling slower than average growth over the near-term.

You cannot invest directly in an index; therefore, performance returns do not reflect any management fees. Returns of the indices include the reinvestment of all dividends and income, as reported by the commercial databases involved. Returns over one year have been annualized.

Source — Bloomberg, Morningstar, treasury.gov. S&P Dow Jones Indices.

Please see PDF for important disclosures.