Key Takeaways:

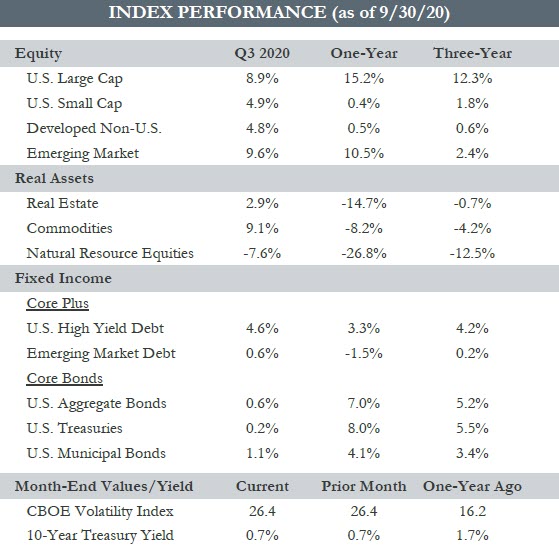

- Another quarter of widespread equity gains, although September was not without its challenges. Volatility reappeared during the month, knocking the S&P 500 off its record highs as the advance of the mega-cap growth names took a breather. Still, the S&P 500 was up 8.9% in Q3.

- Emerging market equities were the top-performing asset class, assisted by strong returns out of China. The MSCI China Index added 12.5% during the quarter, bringing the trailing twelve-month return to over 33%. European equities, while positive, faced headwinds as virus cases in many European countries increased, slowing the economic recovery.

- Interest rates have been pinned at low levels. The 10-year Treasury yield has traded range-bound and sits at roughly 0.7%. Risk-on sentiment through most of the quarter tightened credit spreads, lifting the U.S. High Yield Index.

- The Fed reaffirmed their goals of keeping monetary policy stimulative. The shift to average inflation targeting of 2% and updated recent guidance imply that the fed funds rate may stay near zero through 2023.

- Markets still face many challenges that may add to near-term volatility. Congress has been unable to agree on another fiscal stimulus package, political uncertainty around the November election looms, and ultimately, economic activity and virus trends will play a key role in the market’s direction over the months ahead.

You cannot invest directly in an index; therefore, performance returns do not reflect any management fees. Returns of the indices include the reinvestment of all dividends and income, as reported by the commercial databases involved.

Source — Bloomberg, Morningstar, treasury.gov. S&P Dow Jones Indices.

Quarterly Commentary:

- Macro-data has steadily improved, both in the U.S. and across the globe. Different sectors of the economy are recovering at different rates, but trends are largely positive, and fundamentals look significantly better relative to the state of the economy back in the spring.

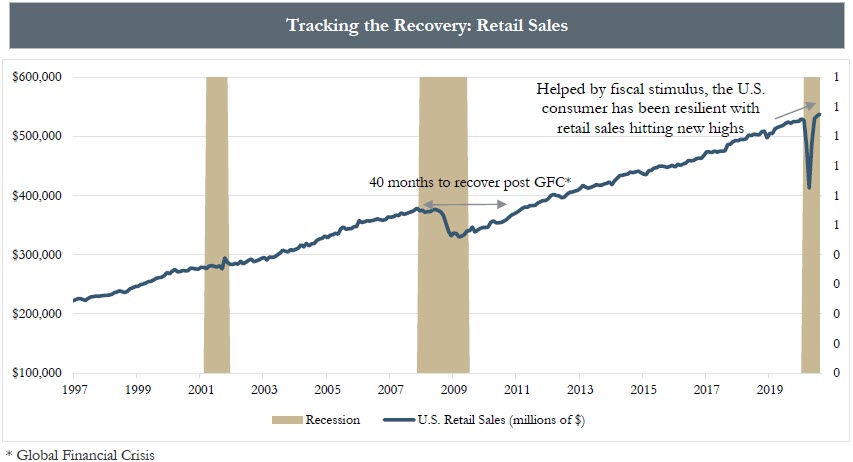

- The current environment is unlike traditional business cycle recessions. The declines have been deeper, but the recovery so far has been steeper.

- Housing has snapped back thanks to historically low mortgage rates. Consumer sentiment is more optimistic about the near-term outlook. Manufacturing is ramping up as demand for goods has remained strong. Labor markets have seen the re-hiring of many workers who lost their jobs in March and April.

- Impressively, retail sales have climbed higher, setting new highs just five months after their January 2020 peak. In the aftermath of the Global Financial Crisis, the recovery in retail sales took 40 months.

- With better fundamentals and firming forward-looking earnings expectations, equity markets have rallied sharply from their lows. Credit markets appear healthy with few signs of stress thanks to support from the Fed.

- So far this year, equity index performance has been concentrated across a handful of the largest growth companies, many of which now hold valuations that seem to be priced for perfection. Opportunities outside of U.S. Lage Cap growth appear more compelling, particularly as fundamentals continue to progress.

- Markets may be choppy in the weeks ahead, as investors work to navigate the uncertainty that this fall will bring. However, the Fed has indicated they will maintain a stimulative approach for the foreseeable future, and fiscal measures can go a long way towards keeping the economic recovery on track.

- Long-term investors should continue focusing on the trends in underlying fundamentals and not the daily swings in sentiment.

You cannot invest directly in an index; therefore, performance returns do not reflect any management fees. Returns of the indices include the reinvestment of all dividends and income, as reported by the commercial databases involved.

Source — Bespoke Investment Group. U.S. Census Bureau, Advance Retail Sales: Retail and Food Services, Total [RSAFS], retrieved from FRED, Federal Reserve